Table of Contents

Do you know why Fintech companies must partner with a cloud service provider? Fintech companies benefit from cloud technologies through automated efficiency and enhanced productivity.

Before we start straight to the point, let’s understand the term Fintech. As the name suggests, Fintech represents ‘financial technology’.

Financial businesses need to access large amounts of data. Fintech companies use this data to understand their customers’ likes and preferences better.

Cloud-based technology helps Fintech companies access these large and complex data. Further, using a cloud-based model prevents the need for maintaining on-premise infrastructure.

In this article, we will explore how cloud-based services help Fintech companies.

Cloud-based solutions help top fintech startups and companies to access, share, store and process data securely on the Cloud. It opens enormous opportunities for fintech companies to create new products and services.

Further, cloud-based services reduce unnecessary costs accrued for on-premise deployment. Fintech companies have realized the increasing popularity of cloud services that they can handle the burden of costs, especially those relating to technology investments and expensive on-premise upgrades.

Also, the agile nature of cloud technology makes it a great choice for Fintech. It helps them to respond quickly to market conditions and trends.

In addition to the technological advantages, Fintech services can also benefit from financial advantages.

They do not require to install costly on-premises servers and can outsource the deployment of server infrastructure to a specialist service provider.

Further, it urges businesses to spend money on advanced safety, helping to improve customer trust. On the other hand, it removes security threats and helps maintain financial compliance standards.

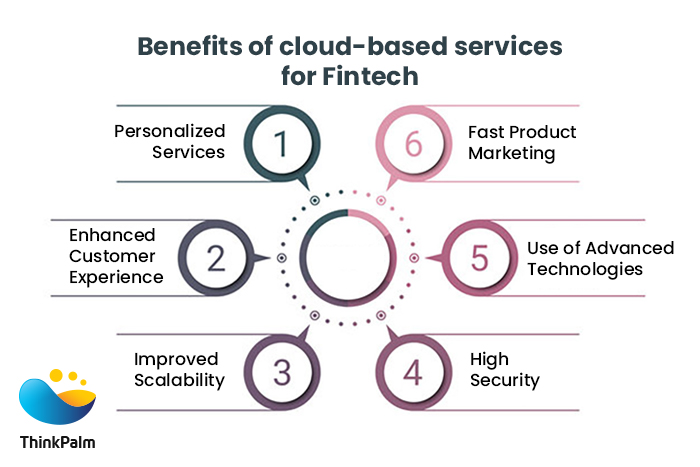

The emerging possibilities for Fintech companies using the Cloud platform are plenty. It allows them to develop new products, services and rely on innovations transforming the financial landscape. Let’s discuss a few key advantages Fintech companies derive from Cloud technology.

Also Read: Benefits of Cloud Computing in Fintech Sectors (Digital Payment)

Do you know cloud-based services offer several advantages for Fintech companies? In the first place, it allows them to enhance their operations without spending money on infrastructure. Further, it allows them to adapt to the changing market conditions and customer demands. Let’s discuss some key benefits of cloud-based services for Fintech businesses.

Cloud-based services allow Fintech companies to access up-to-date data of customers. Top of all, it helps fintech businesses to get data-based insights into the behavioural patterns of customers.

It further offers personalized services, such as customized products based on their preferences.

Financial companies can access large volumes of customer data. Above all, they can make decisions based on customer behaviour and preferences.

There is an increase in the application of AI and ML for several purposes in the finance and banking industry.

With the help of scalable, cost-effective and user-friendly cloud-based services, fintech companies can enhance customer interactions through AI chatbots.

Using cloud-based machine learning and AI, they can offer customers personalized products and services. Further, it helps detect fraud and check compliance with rules and regulations.

The impact of cloud-based services on fintech companies is enormous. As cloud-based services offer reliability, efficiency and convenience, Fintech companies can use them to improve efficiency in their operations.

It helps customers to access accounts in real time. It prevents data loss and any related risks.

Apart from providing customers with personalized services, it gives data-backed insights about customer behaviour patterns.

Customer data protection is at the core of cloud-based services for Fintech companies.

Businesses want to ensure customers that they protect the personal information of their customers.

Choosing a trustworthy cloud services provider lets Fintech companies protect data against security risks.

Cloud-based services transform the way financial businesses function. In addition to the above benefits, it helps Fintech companies scale operations up or down quickly.

Cloud-based services prevent the need for expensive on-premise software and hardware installations. Financial companies need only to pay for what they use.

It further brings benefits in the form of reduced IT infrastructure costs. In the end, it helps Fintech companies allocate resources to other core functions.

Cloud-based services in Fintech help companies to launch products and services quickly. Since the cloud-based platform is agile, developers can make and implement changes without waiting weeks and months, unlike on-premise infrastructure.

Additionally, it helps companies to respond to the market conditions. It keeps its customers updated as well. If you are a Fintech company and use the on-premise Cloud, it takes much time to offer new services.

Also Read: An In-Depth Insight Into Everything There Is To Know About Cloud Computing

Earlier, only a handful of financial institutions relied on the Cloud for their core services.

Do you know small Fintech firms have already started using cloud-based technology to streamline their core functions? For example, they implemented it for banking services and bill payments.

The most welcoming fact is that today, big Fintech firms also rely on cloud-based services to provide better customer service. It helps them to be agile and adapt to changing needs.

It also opens opportunities for Fintech companies to offer new products and services. Adopting cloud-based services lets Fintech companies focus on customer-oriented service.

With the help of cloud-based technology, Fintech companies can adjust to the changing demands of customers. Therefore, it helps them improve customer service by using data to get insights into their behaviour.

Additionally, cloud-based servers offer foolproof security of customer information. Above all, it differentiates them from others and keeps the competition away.

As of now, Fintech companies are adopting cloud technologies at a fast pace for their core functions and operational services.

What factors should you consider while choosing a cloud service provider?

It would be best to look for standards and certifications, technologies used, data governance, information security, business policy, performance track record, service dependencies, reliability, trustworthiness, and support for migration and integration.

What are the fundamental cloud-based services used in Fintech companies?

Companies choosing public cloud technologies rely on three models based on their needs. These cloud service models include Infrastructure as a Service (IaaS), Platform as a Service (PaaS) and Software as a Service (SaaS).

What is the most important feature of cloud-based service?

The most important feature of cloud-based service is that you can upload, access and share data from anywhere, anytime, with the highest security.

Cloud-based services and technology make a great impact on Fintech services. It helps finance and banking companies to improve their operations, customer experience and security measures.

Today, Fintech companies prefer to use the expertise of a cloud service provider who specializes in advanced technologies such as artificial intelligence (AI), machine learning (ML), Internet of Things (IoT) and many more.

If you want to improve your productivity, automate tasks, and improve customer service, adopt ThinkPalm’s cloud services.

It includes several services such as bank statement processing, application form generation, automated background verification, payment processing, share market value and foreign exchange rate syncing.